ri tax rate income

A personal income tax is imposed for each taxable year which is the same as the taxable year for federal income tax purposes on the Rhode Island income of every individual estate and trust. RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay of the amount over 244688 639413 375 475 599 on excess 0 65250 148350 65250 148350 CAUTION.

Taxable income between 66200 and 150550 is taxed at 475 and taxable income higher than that amount is.

. This page has the latest Rhode. Income Tax Rate 0-62550 375 62550-142150 475 142150 599. You can view the sales tax rates for various cities in Rhode Island here.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island government. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. How can we improve this page. 64050 145600 CAUTION.

Tax Rate Income Range Taxes Due 375 0 to 66200 375 of Income 475 66200 to 150550 248250 475 599 150550 648913 599 over 150550. Customize using your filing status deductions exemptions and more. The state income tax system in Rhode Island is a progressive tax system.

Frequently Used Links Tax Forms Sales Tax Regulations Contacting Us Online Services Taxpayer Portal Latest Tax News 2022 Filing Season FAQs - February 1 2022. For 2021 tax year. 2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Using the table below you can see which tax bracket you fall into based on your annual income. 3 rows Rhode Island state income tax rate table for the 2020 - 2021 filing season has three. The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of twenty four states with higher marginal corporate income tax rates then Rhode Island.

We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. Welcome RI Division of Taxation Welcome Administering RI state taxes and assisting taxpayers by fostering voluntary compliance through education and ensuring public confidence. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. Rhode Islands tax system ranks 40th overall on our 2022 State Business Tax Climate Index. TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 64050 145600 But not over Pay--of the amount over 240188 627550 375 475 599 on excess 0 64050 145600.

The rates range from 375 to 599. Send Instant Feedback About This Page Promo Go To Top. Rhode Island State Personal Income Tax Rates and Thresholds.

The Rhode Island state sales tax of 7 is applicable statewide. For income taxes in all fifty states see the income tax by state. 3 rows Rhode Islands 2022 income tax ranges from 375 to 599.

The Rhode Island tax is based on federal adjusted gross. The employer tax rates in these schedules include a 021 Job Development Assessment which is credited to the Job Development Fund and a 003 Reemployment Assessment for calendar years 2001 2002and 2003 that is credited to the Employment Security Reemployment Fund. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

TAX RATES APPLICABLE TO ALL FILING STATUS TYPES 475 599 c Multiply a by b d Subtraction amount 000 66200 252882 RHODE ISLAND TAX COMPUTATION WORKSHEET a Enter the amount from RI-1040 line 7 or RI-1040NR line 7 Amount 25200 25250 946 25250 25300 948 25300 25350 950 25350 25400 952. Now that were done with federal income taxes lets tackle Rhode Island state taxes. Residents of Rhode Island are also subject to federal income tax rates and.

Rhode Island Income Tax Calculator - SmartAsset Find out how much youll pay in Rhode Island state income taxes given your annual income. Your 2021 Tax Bracket to See Whats Been Adjusted. DO NOT use to.

Many states also base their tax structure on filing status but Rhode Island utilizes the same bracket system for all filing types. Any income over 150550 would be taxes at the highest rate of 599. There are three tax brackets and they are the same for all taxpayers regardless of filing status.

The state has a progressive income tax broken down into three tax brackets meaning the more money your employees make the higher the income tax. The tax breakdown can be found on the Rhode Island Department of. 2022 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Did you find what you were looking for. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. The tax brackets are the same regardless of your filing status and tax rates range from 375 to 599.

Rhode Island has a 700 percent state sales tax rate and does not levy local sales taxes. The first 66200 of Rhode Island taxable income is taxed at 375. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates.

Rhode Island has a flat corporate income tax rate of 7000 of gross income. Rhode Island State Personal Income Tax Rates and Thresholds. Discover Helpful Information and Resources on Taxes From AARP.

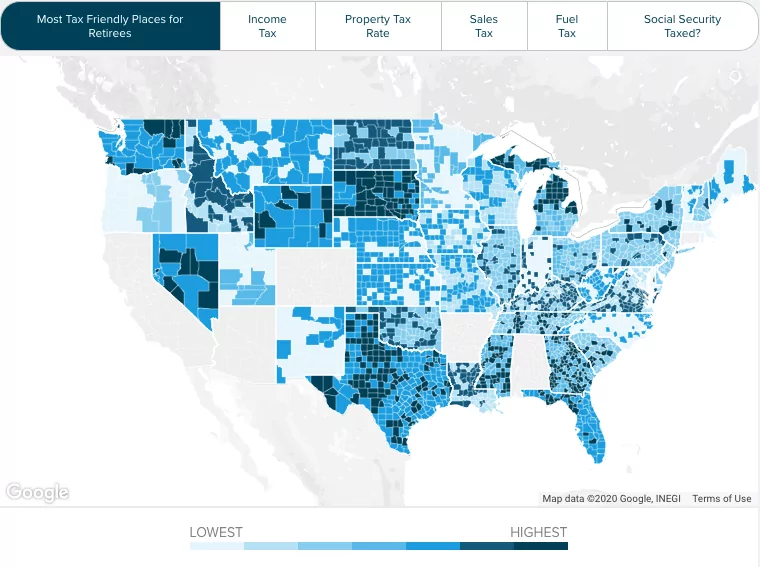

We value your comments and suggestions. For more information about the income tax in these states visit the Massachusetts and Rhode Island income tax pages. Our Rhode Island retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income.

Rhode Island also has a 700 percent corporate income tax rate. For an in-depth comparison try using our federal and state income tax calculator. 4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax.

This form is for income earned in tax year 2021 with tax returns due in April 2022. Ad Compare Your 2022 Tax Bracket vs.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Rhode Island Income Tax Calculator Smartasset

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Rhode Island Income Tax Calculator Smartasset

Rhode Island Retirement Tax Friendliness Smartasset

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Rhode Island Sales Tax Small Business Guide Truic

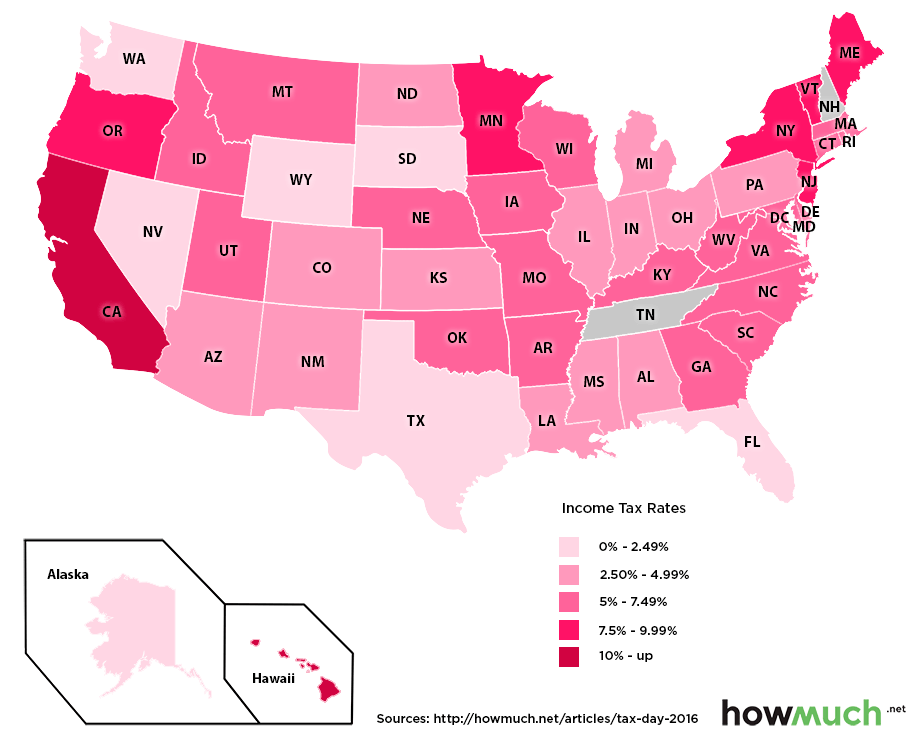

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Historical Rhode Island Tax Policy Information Ballotpedia

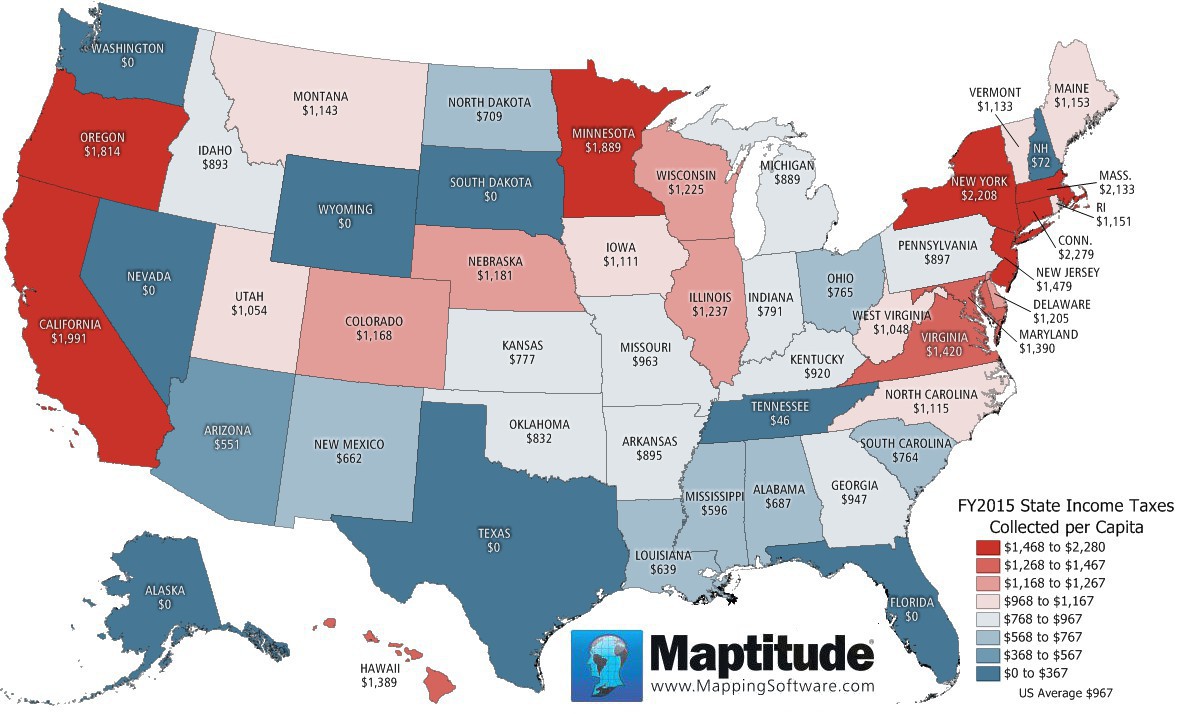

Maptitude Map Per Capita State Income Taxes

Rhode Island Income Tax Brackets 2020

Which U S States Have The Lowest Income Taxes

Who Pays 5th Edition The Institute On Taxation And Economic Policy Itep Income Tax State Tax Low Taxes

Where S My Rhode Island State Tax Refund Taxact Blog

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)